Those who make more money from the system will pay a more equitable share of their income as tax towards the public good.

A clear roadmap to achieving this national imperative was outlined at the weekend in Abuja on the final day of the Federal Inland Revenue Service (FIRS) Management Retreat by paper presenters, discussants and the audience who rubbed minds over the 2019 Finance Act.

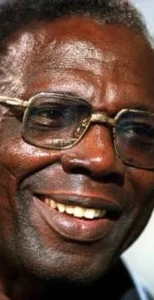

The Lead Paper delivered by renowned tax expert, Mr. Taiwo Oyedele, titled Strategies for implementing the New VAT Regime and the panel discussion which dismissed erroneous public apprehension that the new 7.5% VAT would impact negatively on poor Nigerians as it made clear that the well-to-do would now pay their fair share of taxes in the country unlike before.

Oyedele noted that “the key to building this fair, equitable tax system is transparency, accountability, integrity, work and objectivity to build confidence in taxpayers and stakeholders in the tax sector.”

Towards accomplishing this, the FIRS 2020 Corporate Plan was also unveiled at yesterday’s session and subjected to a robust, on-the-spot debate, according to a statement made available to the media in Abuja by Director of Communications, FIRS, Abdullahi Ismaila.

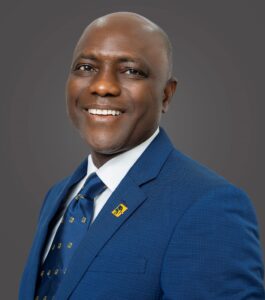

Capping the day was the official presentation of the new FIRS Organizational Structure as approved by the Services Board. Presenting the new organizational structure, Executive Chairman, FIRS, Mr. Muhammad Nami, disclosed that many posts in the organogram were vacant and open to the FIRS officials.

He charged staff of the FIRS to distinguish themselves in the shortest possible time by meeting set collection targets in order to take up these available positions of higher responsibilities, stressing that the vacancies are strictly available on measurable merit and performance criteria only.

By Nduka Chiejina