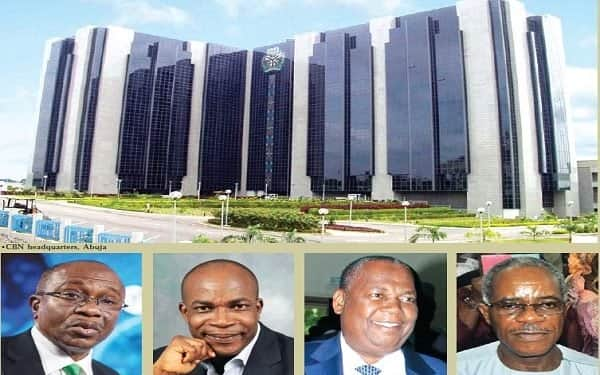

The Central Bank of Nigeria (CBN) and Nigeria Deposit Insurance Corporation (NDIC) presented opposing recommendations to the Senate on the ongoing amendment to the Banks and Other Financial Institutions Act (BOFIA). The NDIC is seeking more powers to aside insuring depositors’ funds, participate in the licensing of banks. But the apex bank has rejected the proposal, insisting that the global best practice is to have a legislation that empowers the central bank-the financial sector regulator- to license, regulate, supervise banks and promote their soundness and stability. The NDIC is expected to step in after the revocation of operating licenses of banks for the payment of insured depositors, writes COLLINS NWEZE

The question on which agency should license, regulate and supervise banks and other financial institutions is now a top issue in the Nigerian banking sector. Two top institutions- the Central Bank of Nigeria (CBN) and Nigeria National Deposit Insurance Corporation (NDIC) are now contesting for new and expanded roles in the Banks and Other Financial Institutions Act (BOFIA) undergoing amendment at the Senate.

This face-off has been of concern to stakeholders, considering that it is never in the interest of the financial system to see two key regulators at daggers drawn over banking regulation.

From licensing, supervision to liquidation of banks, the two top regulators have presented divergent views on how their work should be segmented and executed. The CBN Governor, Godwin Emefiele and NDIC Managing Director, Umaru Ibrahim took the positions they wanted reflected in the new BOFIA 2020 to the Senate Committee on Banking, Insurance and Other Financial Institutions public hearing held last week in Abuja for consideration.

The Committee held a public hearing on its Bill for an Act to repeal the Banks and Other Financial Institutions Act 2004 and re-enact the Banks and Other Financial Institutions Act 2020.

The Bill, sponsored by Senators Uba Sani and Betty Apiafi had earlier passed through first and second reading on the floor of the Senate following which it was passed to the Committee on Banking, Insurance and Other Financial Institutions for further legislative action. The public hearing attracted a diverse group of critical stakeholders within the financial services sector, in addition to other relevant public interest groups.

The CBN in her lead presentation recognised that whilst the extant BOFI Act 1991 (and amended in 1997, 1999 and 2002) provided appropriate foundation for the growth and development witnessed in Nigerian banking sector over the last three decades, significant financial, socio-economic and technological transformations that are being witnessed necessitate review of the legal framework to ensure that it remains fit-for-purpose.

The bank alluded to widespread innovation in channels for delivering financial services, emergence of new types of regulated institutions, advancements in supervisory techniques and methodologies as some of the contemporary developments that necessitate the need to upscale the legal framework for banking regulation and supervision in Nigeria.

The CBN commended the Senate Committee for the amendments already incorporated into the Bill to address some of the observed areas. It however, recommended additional areas for the Committee’s consideration, learning from its practical experiences garnered over time in the course of regulating and supervising banks, specialized banks and other financial institutions in Nigeria:

Review of framework for managing failing institutions in line with international standards to properly delineate roles for the agency tasked with managing failing banks and other financial institutions and those with responsibility for resolving banks and other financial institutions whose license have been revoked. In other words, the Central Bank of Nigeria does the former as provided in the BOFIA while NDIC is saddled with the later under the NDIC Act.

The global best practice is to have the banking legislation empower the Financial services industry regulator to regulate banks, promote their soundness and stability; superintend issuance and revocation of operating licence without recourse to any other institution while the deposit insurer is in charge of bank resolution activities after the revocation of operating licence.

But the NDIC boss, Ibrahim, said there are variances in the Bills that may be perceived as overlapping mandates between the NDIC and the CBN should be clarified in order to avoid any ambiguity in the laws governing their operations and should be reflected in the BOFIA 2020.

This, he said was specifically critical in the area of the resolution of failing banks where the NDIC should be recognised as the primary actor in the resolution process while the CBN intervenes in the event of systemic crisis.

He also expressed the need for the Corporation to be involved in the process of licensing banks in collaboration with the CBN in order to ensure the necessary fit and proper checks and to establish clearer assessment of the status of financial institutions before licensing.

He also noted that the bill seems to suggest the option of the appointment of other entities in the liquidation of failed banks adding that the Bill should be amended to reflect the NDIC as the sole liquidator of failed banks based on the Corporation’s core mandate of Bank Liquidation.

He said, the clear delineation of roles between the NDIC and CBN would strengthen the legal framework and contribute towards effective and efficient collaboration in the supervision and regulation of the Banking Sector.

Stakeholders speak

The stakeholders agreed that the war between the CBN and NDIC dates back to 1997 when the NDIC was accused by the CBN of usurping its regulatory roles. By 1998 however, the CBN was able to retain its regulatory position in the financial services sector.

Speaking on the development, former President, Chairman of Council, Chartered institute of Bankers of Nigeria, Okechukwu Unegbu, said the NDIC needed to know that their core function is deposit insurance. Licensing of banks is totally outside of NDIC’s assigned role, hence they should rather concentrate on how to ensure that ensured depositors get their funds in good time after a bank is liquidated.

The former CIBN boss wanted to know while the NDIC wanted to take more functions, instead of perfecting the ones already assigned to it. “There should be a court ruling confirming that a bank has failed, before liquidation begins. That process is very slow, and that’s where I want the NDIC to look into. There is one that I am involved in that has taken years and that does not give confidence to depositors,” Unegbu said.

Continuing, Unegbu said: “The Senate should not make that mistake of giving the NDIC power to license banks because the corporation should not be part of a licensing process for a bank it wants to insure. Doing that will lead to conflict of interest and really hurt the financial system”.

Former Executive Director at Keystone Bank, Richard Obire, said overlap of roles can hinder effective regulatory oversight, hence the need for the updated law that provides clarity on each regulator’s role in the new BOFIA 2020.

He said that as a developing country, Nigeria needs a central bank whose roles are not limited to microeconomic management, but have full control of what happens within the banks and financial system.

This he said, will enable the CBN properly gauge the state of the economy and have the total picture of what is happening, which helps it in taking key decisions on interest rate, exchange rate and inflation rate.

“There is no need for the NDIC to be involved in some of the issues it is advocating for, like licensing of banks and regulating banks. We should draw the line. Once a bank or other financial institution goes down, it will be time for NDIC to step in. But what ever regulation that is needed before that time, should be provided by the CBN. Anything outside this, will create regulatory confusion, and duplication of roles that will left many things undone,” he said.

Obire said where a regulator take up more roles outside its core competent areas, then its core functions, which it was created to provide will suffer.

He said he does not expect the CBN to contemplate providing deposit insurer role, and also does not expect the NDIC to even think of playing any role in licensing of banks.

Also speaking, President, Bank Customers Association of Nigeria ( BCAN) and former Registrar/ Chief Executive, Chartered Institute of Bankers of Nigeria, Uju Ogubunka, said the BOFIA 2020 should be specific on who is uncharge of what.

He said: “The CBN has commitment with banking sector issues of regulation, licensing and stability while NDIC is purely on deposit insurance. However, on issues around getting CBN’s approval to carry out certain functions, my thought is that the apex bank can just be notified. And if it comes that there must be an approval from the CBN, the new law can specify the exact timeframe under which the CBN should approve or decline the request”.

Ogubunka said regular supervision by the regulators, can disrupt the system, hence both institutions should always carryout joint checks on the banks’ books.

More Demands by the CBN

The CBN also asked for powers to restrict remedy for successful action against revocation of license in line with international standards, enhance failing bank recovery and resolution tool kit to give more options for managing failing institutions and systemic crisis without recourse to public treasury.

Also power to creation Credit Tribunal to strengthen credit recovery processes and enforcement of collateral rights, strengthen the framework for reporting for insider transactions as part of measures to boost credit administration processes in banks and enhancements to regulatory measures for single obligor limits, transfer of significant holdings, among others.

There was also demand for the strengthening of the Sanctions Regime to make it more deterrent, review of provisions to recognize the unique business models of new entrants into the financial services sector , effective management of dormant accounts to ensure efficient administration for ultimate benefit of the owners of the funds and/or their beneficiaries, enhanced requirements for payments, settlement and clearing activities to address unfolding developments and standards for regulations and supervision of Systemically Important Banks given the risk that their activities pose to the financial system.

Additional Demands by NDIC

The NDIC also sought express prohibition of insider loans/criminalising insider loans by making it an offence punishable with imprisonment and fine for directors of licensed banks to obtain credit facilities from their own banks, whether such credit facilities are secured or not.

The Corporation noted that there is no need for approval of the Central Bank to be sought in the implementation of supervision, control and management and distress resolution of banks as reflected in the Bill as this constitutes the core mandates of the Corporation.

The Corporation should therefore carryout these functions in consultation with the CBN not with the consent of CBN as both institutions are independent and compliment the functions.

Directors of banks should be held are personally liable without any limitation for the causes of the failure of their banks where they have been found to be negligent in managing the bank.

The imposition of penalties and persecution of various offences to serve as a deterrent to officers and directors of banks and will ensure that the banking industry ensures compliance with available laws and regulation in order to avoid paying stiff penalties.

According to financial pundits, the NDIC is also expected to give assistance to insured institutions in the interest of depositors, in case of imminent or actual financial difficulties particularly where suspension of payments is threatened to avoid damage to public confidence in the banking system among other roles.

The above responsibilities should form the basis of the mandate of the Corporation, because it does not differ from those in other jurisdictions including Canada, Malaysia, and Japan.

Therefore, the new powers that the Corporation seeks to assume and exercise are not only difficult to subsume under its responsibilities as detailed above, but are alien to deposit insurance practices in those jurisdictions.