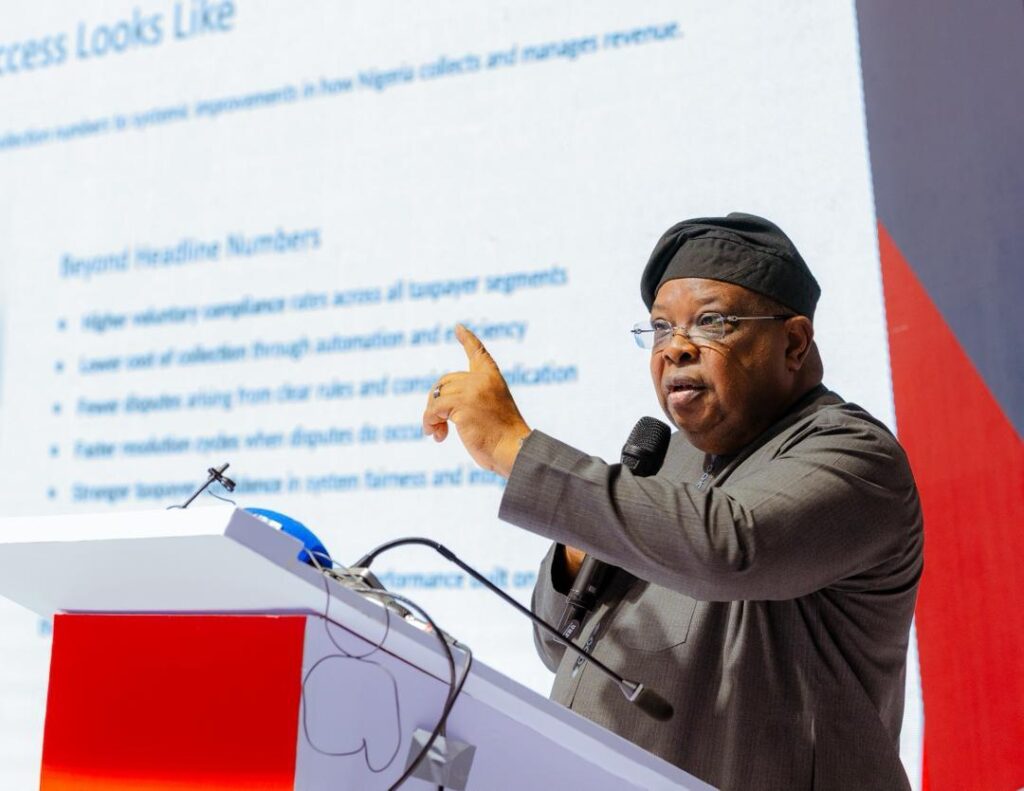

Joseph Tegbe, Chairman of the National Tax Policy Implementation Committee (NTPIC), has emphasized that the success of Nigeria’s recently enacted tax reform framework will rely less on the ambition of its legislation and more on the discipline of its execution. Speaking at the 2026 Leadership Retreat of the Nigeria Revenue Service (NRS), Tegbe underscored that the country’s tax reform journey is at a critical juncture where effective implementation will determine long-term fiscal outcomes.

Tegbe highlighted that Nigeria’s tax-to-GDP ratio remains among the lowest for major economies, constraining fiscal flexibility and heightening vulnerability to fluctuations in oil prices. With public expenditure pressures rising and macroeconomic stability increasingly dependent on sustainable domestic revenue mobilization, he argued that institutional performance is now the primary driver of fiscal resilience.

According to Tegbe, the passage of 4 new tax laws marks only the beginning of a broader reform agenda. He described the initiative as a systemic recalibration of Nigeria’s fiscal architecture, rather than a routine policy update. The true measure of success, he asserted, will be the credibility of implementation, not the design of the laws themselves. The NRS, he noted, functions as the nation’s “Revenue System Integrator,” with outcomes reflecting the strength of an interconnected ecosystem that encompasses policy clarity, enforcement consistency, digital infrastructure, dispute resolution efficiency, and intergovernmental coordination.

Central to Tegbe’s address was the principle that tax policy must serve as an enabler of governance. He stressed that the framework must embody simplicity, equity, predictability, and administrability at scale. These principles, he explained, foster voluntary compliance, reduce operational friction, and strengthen investor confidence. By contrast, ad-hoc adjustments or policy drift, he warned, could undermine reform momentum, unsettle businesses, and deter investment, which thrives on predictable rules rather than shifting announcements. Structured sequencing, clear transition mechanisms, and continuous feedback between policymakers and administrators are therefore critical to sustaining reform credibility.

Tegbe further argued that revenue reform cannot succeed in isolation. Achieving sustainable gains requires a whole-of-government approach, leveraging robust taxpayer identification systems, integrated financial data, efficient dispute resolution, and harmonized coordination across federal and sub national levels. This approach, he said, reduces leakages, eliminates multiple taxation, and reinforces confidence in the system.

Importantly, Tegbe expanded the definition of reform success beyond headline revenue figures. Durable reform should be measured by higher voluntary compliance rates, lower administrative costs, fewer disputes, faster resolution cycles, and stronger taxpayer confidence. “Sustainable revenue performance is built on trust and efficiency, not enforcement intensity,” he concluded, emphasizing that the legitimacy and predictability of the system are more critical than punitive measures.

With the legislative framework now firmly established, Tegbe noted that Nigeria’s focus has shifted from policy design to effective delivery. The next phase, he stressed, will be defined by the consistency, coherence, and discipline with which the reforms are implemented. Execution, therefore, is the defining variable in the next chapter of Nigeria’s revenue transformation. The country’s ability to achieve lasting fiscal resilience and broaden its revenue base will depend on disciplined, credible, and integrated implementation across all levels of government, ensuring that the promise of reform translates into measurable, sustainable outcomes for the economy and citizens alike.

In summary, Tegbe’s address framed Nigeria’s tax reform not merely as a legislative accomplishment but as a transformative journey requiring operational rigor, institutional alignment, and a focus on trust, compliance, and efficiency. The success of this agenda, he made clear, hinges on execution discipline—making it the single most critical factor in shaping the nation’s fiscal future.

For Advert, Event Coverage/Press Conference Invite, Story/Article Publication & Other Media Services

Contact Us On WhatsApp

Send Email To: citizennewsng@gmail.com

Visit Citizen NewsNG To Read More Latest And Interesting News Across Nigeria And The World